How Real Estate Taxes Florida can Save You Time, Stress, and Money.

Table of ContentsThe Best Strategy To Use For Real Estate Taxes FloridaThe 7-Minute Rule for Real Estate Taxes FloridaIndicators on Real Estate Taxes Florida You Need To KnowReal Estate Taxes Florida Fundamentals ExplainedReal Estate Taxes Florida - An OverviewThe Best Guide To Real Estate Taxes Florida

If eligible, it is crucial that you file so that you are correctly analyzed the homestead tax obligation rate on your residential property. Right here is the information you as the property proprietor require to know regarding the Vermont Homestead Declaration.For this purpose, property is categorized as either nonhomestead or homestead. A homestead is the major house and parcel of land surrounding the residence, possessed as well as occupied by the homeowner as the individual's domicile. All residential or commercial property is considered unless it is declared as a. The education property tax rate levied on nonhomestead residential property varies from the rate levied on homestead residential or commercial property.

If you satisfy these needs, except that your homestead is leased to a renter on April 1, 2022, you may still claim it as a homestead if it is not rented for greater than 182 days in the 2022 schedule year. Residential property is considered nonhomestead if among the adhering to applies: Your home is leased for even more than 182 days out of the fiscal year.

Real Estate Taxes Florida for Dummies

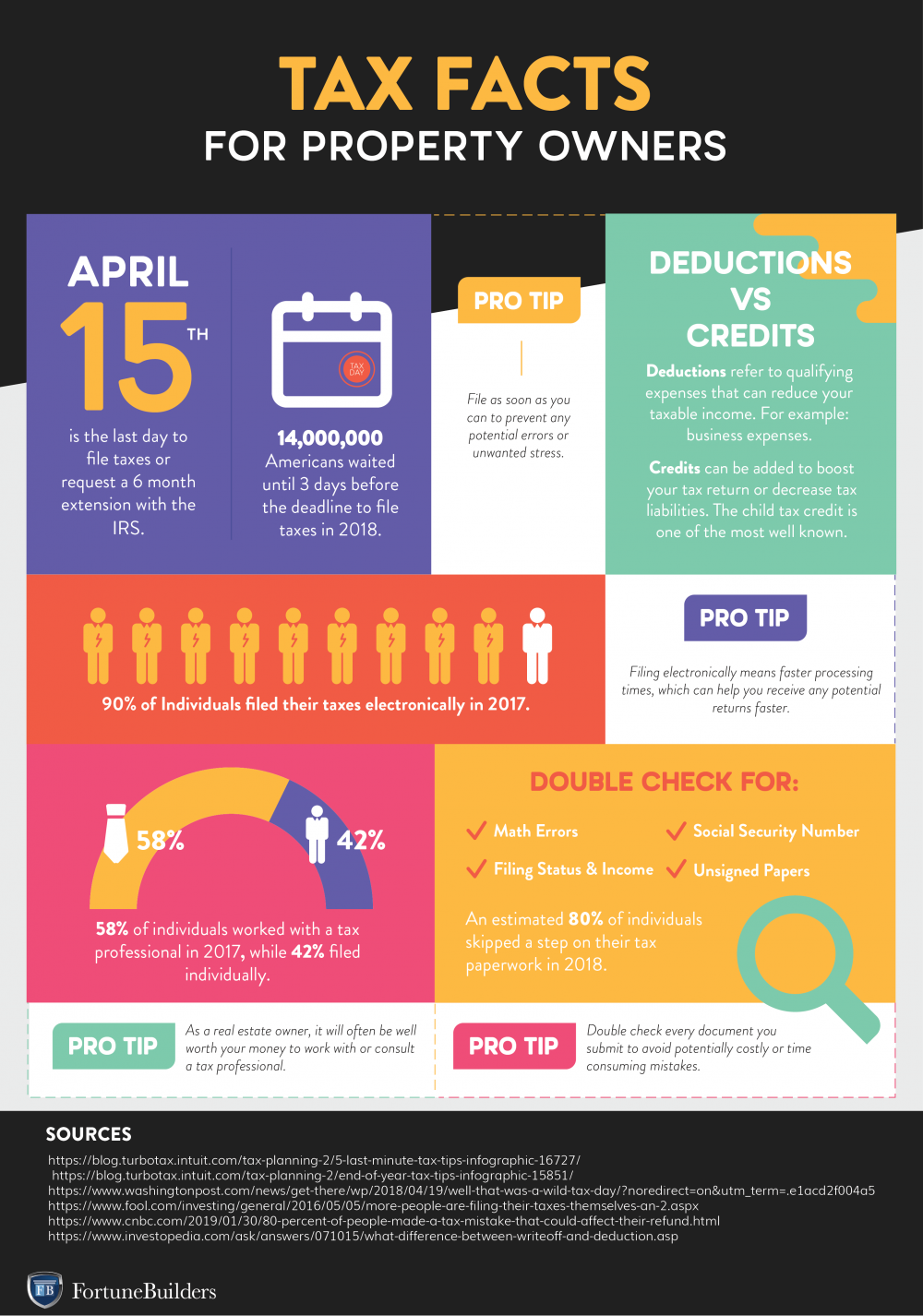

Many individuals file their Homestead Affirmations at the exact same time they submit their Vermont tax return. If you use to prolong the time to submit your income tax obligation return, the Homestead Declaration need to still be submitted by the April filing deadline. Even if an individual is not required to submit a Vermont Earnings Tax Return, the affirmation should be filed by the target date.

Along with the homeowner's standard details, you need to have the adhering to available when filing: The property's College Home Account Number (PERIOD) published on the residential or commercial property tax obligation bill The homeowner's Social Safety and security Number The code of the Vermont college area in which the home lies, which may be located on the real estate tax expense (the college code is the center 3 digits of the SPAN).

6 Simple Techniques For Real Estate Taxes Florida

Kevin specifies a home record as a photo appearance at ownership of home vesting, existing liens versus a property, tax, and also judgments. Residential or commercial property reports reveal the tax obligation circumstance. They give a glance at the total problem of a residential property: who possesses it, when they entered into title, more information and also an analysis of residential property.

Kevin responded with "information remedies can serve a variety of needs in genuine estate (real estate taxes florida). Information Trace has the most effective quality and also depth of information in the country as well as it is essential because it can respond to most inquiries people have regarding genuine estate." The specific procedure of how property reports are retrieved is they are purchased by proprietor's name as well as address then the tax report, the home chain report, and the vesting deed are drawn.

There is a huge worth in residential property reports and also it is inescapable that they are crucial. We have all listened to regarding the tax benefits of owning rental actual estate. Most rental property investors do not understand many of the tax obligation benefits, especially real estate devaluation.

Devaluation is essentially a non-cash deduction that decreases the investor's taxable income. Many capitalists refer to it as a "phantom" expenditure because they are not actually creating a check. It is merely the IRS enabling them to take a tax obligation deduction based on the regarded reduction in the value of the real estate.

But we know this is not generally the instance. Not many other kinds of financial investment offer comparable devaluation reductions. As a result of realty devaluation, the capitalist may in fact have capital from the building yet might show a tax loss. The benefit obviously is to decrease the general tax liability (topic to particular restrictions).

The 2-Minute Rule for Real Estate Taxes Florida

The building must have a determinable useful life of greater than one year. First of all, land is not depreciable. look at this website Assuming you have rental actual estate, you can decrease the building, significant improvements, and any type of tools that is used in the procedure of the residential or commercial property. Depreciation commences when a taxpayer positions property in solution and finishes when the residential or commercial property is disposed of or otherwise relinquished solution.

Upon personality of the residential property, this depreciation is essentially regained. The actual property devaluation calculation is not too difficult. Here's exactly how you would certainly determine it in 3 simple actions: Realty value is made from land and also structure values, however depreciation just relates to the building. Very first step is to allot the residential or commercial property's acquisition price should be assigned between land and also structure value.

Actual estate depreciation is a vital tax obligation deduction for real estate capitalists as well click this site as ought to not be forgotten. Paul B. Sundin is a CPA and also tax obligation strategist.

Excitement About Real Estate Taxes Florida

You can discover out more details on him by seeing . Ought to you have any questions for Paul, you can reach him at 480-361-9400. Use any info from this short article is for general information just, and does not represent individual tax obligation suggestions either share or suggested. Viewers are encouraged to seek expert tax recommendations for individual revenue tax concerns as well as support.

Once you have situated your residential or commercial property click to see the details and on the best side of the screen will be an option for tax obligation bills. Credit report and Debit card settlements for Real Estate tax obligations are accepted during active tax obligation accumulating period as well as online just.